In the coming years, Klarna’s valuation will be higher than four of Sweden’s largest banks, Handelsbanken, Swedbank, SEB and Nordea combined. Here’s the analysis of how Klarna is putting together a new banking bundle:

WHAT?

🚗 Self-driving finance / invisible banking is becoming a reality and companies like Klarna is driving this change

💳 📉 Credit card purchases in decline in favour for direct debit and BNPL, driving a change in the perception of credit

SO WHAT?

👴🏼 Incumbents are behind the curve as the paradigm is about to change

💵 New models increase merchants turnover, and lowers credit costs for consumers

NOW WHAT?

🙋🏻♀️ Massive restructuring of business logic; now people follow people, not brands – new winners to emerge

🎯 Being a consumer brand opens possibilities to create banking services in new areas, creating a future banking bundle

HATERS WILL BE LIKE…

🚧 Klarna will find it hard to compete with huge players such as Stripe and Paypal

📉 Payments is commodity business, profits eventually go to zero

♻️ Sustainability? Nah, not really. Increasing shopping isn’t exactly one of the SDG’s.

🏢 There are compliance issues one the horizon. Governments will take it down.

☯️ Incumbents have huge moats, and can adapt to changes in the market

What?

Have you heard of the term BNPL? Behind the acronym you’ll find what’s known as credit for people born before Y2K. It stands for ‘Buy Now Pay Later’. In essence, this is what credit cards and consumer loans have been providing since the middle of the last century.

The proliferation of e-commerce has been driven largely by lowering the thresholds and accustoming people to be more inclined to leave their credit card details online. We are now nearing a point where all businesses are online and paying is literally as easy as 1-2-3.

Data shows that credit card usage is in decline, and that younger generations are favouring credit free payment in four to six installments. BNPL discovers a need that credit card companies were unable to meet and is clearly driving a change in behavior and perceptions.

So what?

Why Klarna will disrupt personal finance management

So, why is BNPL such a big deal? Largely because it’s spreading like fire, and as such, driving the automatization of our day-to-day finances. Paying bills and managing our wallet will become something that just happens while we’re busy making other plans.

There’s a potential valuable proposition for the players in this field to aggregate our BNPL purchases. The service would cut the highs and lows to a predictable monthly cost, and let the consumer know if there is room for more purchases or if there’s a need to step off the gas.

Open banking standards only a few years in the making, effectively erases the barriers posed by banks, to hold the consumers transaction accounts. Meaning, any bank, including Klarna can now own the customers wallet.

Leading this shift in consumer behavior around payments, poses an existential threat to Visa and Mastercard, as well as the incumbent banks.

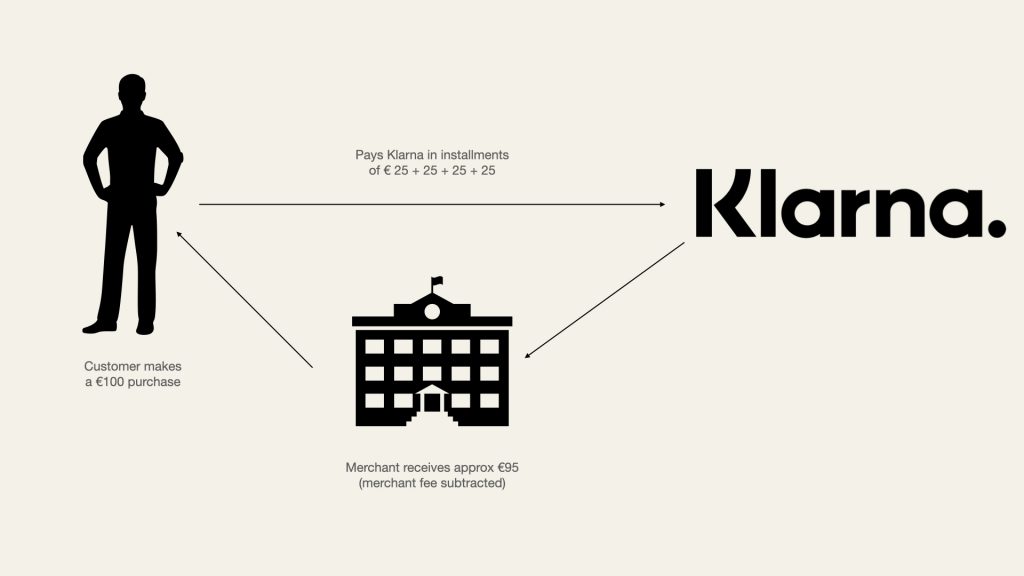

The strength of a three sided business model

To buy and pay later is in itself nothing new. Fundamentally It’s credits re-engineered and jammed on a three sided business model that displaces historical incentives and drivers. In this model, the merchant, the e-commerce platform and the customer making the purchase are all benefactors, whereas historically, the consumer more often than not ended up in a credit crunch, due to the typically higher credit limits, late fees etc. And merchants were’nt happy either, seeing increasing cost of transactions, and no business drivers such as increased conversion or volumes.

Merchants

There’s a variety of data showing that cart size and conversion rates increase substantially with the BNPL-option. In one instance Klarna claimed an increase of 58 percent in average order value and 30 percent in conversion rates. Clearly this is a boon for retailers and merchants made possible by the BNPL-model.

Customers

Inspiring and curating shopping. lowering thresholds to purchase and after purchase management with shipping etc. Essentially, making life simpler, and more smooth. What’s not to like?

Platforms

As e-commerce becomes even more important for smaller businesses, with less tech-abilities, easy integration, stability and functionality becomes essential. All outsourced of course.

Profitability in BNPL is probably awesome

As loan maturity is short, typically 3-6 weeks, the capital involved can be used multiple times per year. So let’s say, for our €100 purchase above, Klarna takes €5 from the merchant and for lending capital for approximately five weeks. The same capital can then be reprocessed 10 times during a year (50 weeks) which gives Klarna €50, and with a margin of 30 percent, that equals €15. Most banks would say that’s pretty good.

And these are moderate numbers. Capital velocity as well as margins could most likely be much higher. As Klarna is increasing the merchants volumes, the take rates also might increase.

Now what?

Structural changes that Klarna will leverage

Looking forward, the most interesting shift of the BNPL model is the creation of a new type of relationship with the customer. In this regard, Klarna is leading.

People follow people, not brands

In most businesses, the closer you get to the customer, the easier it is to make a profit. For a long time, retail brands naturally have been top of mind of consumers and as such, leading them to purchase. But this seems to be changing. One of the strongest trends in commerce is that people follow, and act on impulses from other people (i.e. influencers) not brands.

As retail goods overflow the consumer; curation, aggregation and guides is a necessity and a utility that shoppers now can’t live without. Companies like Klarna, and Australia’s Afterpay among others have understood and built their service around this logic.

Super-curators will supersede brands and become the new gatekeepers

Claiming that position, and getting in, in front of the brand then is a key to owning the customer. Although, it doesn’t stop there. As customers have finalized the purchase, they take care of payments (obviously), but also keep us up to date on delivery and returns. Basically, they are following the customer throughout the entire purchase cycle. Few services can do that.

The combination of lowering purchase thresholds and substantially increasing traffic to merchants makes Klarna a very good business proposition.

They who owns content owns the deal

Smart marketing is not ads – its content. Content has a way of creating relationships, traffic and long term behavioral changes. The combination of super curators creating content that attracts audiences, will lead to repeat purchases.

The ecosystem then comes together. What was previously fragmented across different parts of the internet, in blogs, social media, brands and retailers and traditional media, now coincides where the purchase can be made. And owning, and managing a trusted marketplace end to end has got to be a lucrative deal.

You need scale to be culturally relevant

Maybe you’ve wondered why Klarna spent tons of money getting Snoop Dog to deliver it’s smooth credo? The answer lies, at least in part in the ambition to be a culturally relevant brand.

One of the advantages of digital marketing also has one major counter effect. Creating small niches is efficient but also means it is difficult to become a broad cultural phenomena. The reason large brands have such clout and impact is because of signaling.

Nike is culturally relevant and safe. I can buy a pair of Nike shoes, because I know what that brand stands for. And we both know what it says about me as an individual and we share those values. This signaling effect propels brands from niche players to cultural phenomena. This is important to have when you are in the business of turning millions of people into followers and shoppers.

Telling someone you shop with Klarna then comes with no raised eyebrows or questions marks. To achieve this, huge ‘above the line’-campaigns need to be plastered all over Europe and the U.S.

What will have to happen for Klarna to succeed?

⭐️ A consumer brand with scale that increase volumes for merchants

⚙️ An operating system that’s more efficient than their competitors’

💰 Scale the corporate narrative to ‘the global marketplace’

The global consumer brand

The payments ecosystem is vast, and complex. Klarna is by no means alone in this segment. Nor, is it dominant in size. PayPal is the largest player in the number of merchants using its services, with Stripe as runner up.

There seems to have been something going on behind the scenes between Klarna and PayPal. This Tweet from Sebastian Siematakowski sent the rumour mill spinning as they now have launched its own BNPL service, “Pay in 4”.

Thank you CNBC for making it official: Klarna is now the global innovation leader and Paypal the follower. We are humbled but eager to push the innovation and customer centricity in this industry forward at an increasing pace! @CNBC @PayPal https://t.co/LPSgCVOMew

— Sebastian Siemiatkowski (@klarnaseb) October 14, 2020

Even though they have a BNPL-service in their lineup, Stripe is geared towards developers, and large scale integrators. PayPal, as huge as they are, might find it difficult to create a relevant brand to become a shopping gateway and influencer.

Klarna however seems to be spearheading the idea of creating an end-to-end consumer experience. For Klarna to succeed the idea of being a consumer brand with the ability to increase volumes for merchants must hold. They need to create an even stronger position in the buying cycle, and owning an increasing amount of customers’ wallet.

Moats v abilities

As so many things these days, the most valuable resource is the ability to deliver value consistently over time. To do that, one has to gather data quickly and be able to adjust and refine the model. Even though moats and barriers to entry are still valid competitive forces, there seems to be a shift towards abilities and adaptability.

At the moment capital is easily accessible, but skill and strategic nimbleness is scarce and valuable. They who have the ability to understand, learn and adapt the fastest will eventually win.

From that viewpoint, players such as Visa, Mastercard, Paypal might lack the fluidity and above mentioned qualities that you’d find in Klarna and their smaller peers.

The bull case of Klarna is basically dependent on their operating system. It must function better, more efficiently and smarter than their competitors and that the industry titans are strategically encumbered by their size and inability to change.

Corporate narrative to follow?

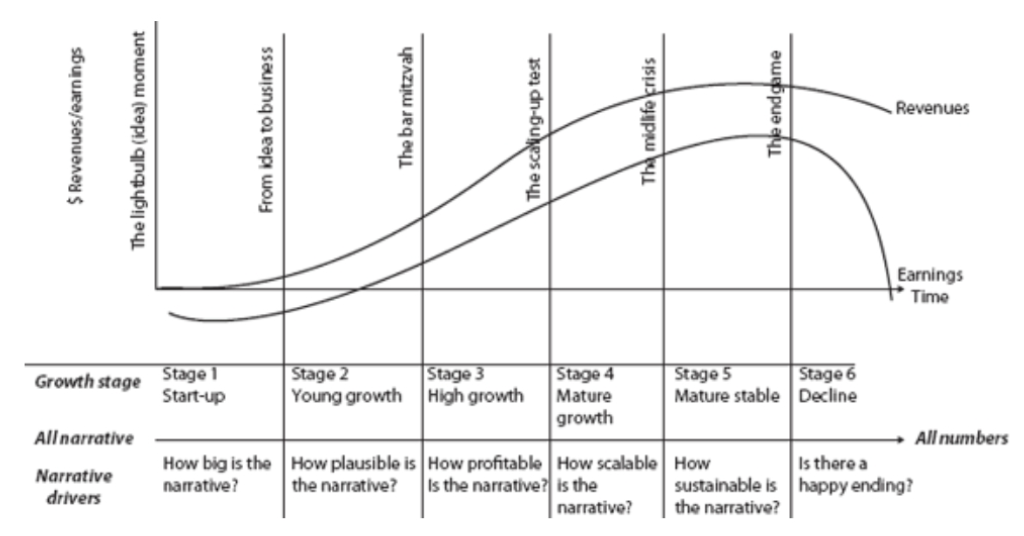

Klarna is on a path to transform from narrative to profitability. So far they have transformed from the early startup phases with to a clear lead on the fintech scene. Following the lifecycle of startups outlined by Aswath Damodaran (in the book Narrative and Numbers) Klarna is hovering at stage three, with high growth paired with the impending question – how profitable is the narrative? And further on, can they scale this narrative of being on the consumer side, creating an all encompassing marketplace?

Conclusion

Smooth shopping is probably more than just a catchy slogan. To smoothen the edges in every direction is very likely a credo to which they build their offering. As they continue to innovate it can quite possibly be applied to new business areas.

As large banks wearily looked over their shoulders, not knowing what to do – startups such as Klarna, Stabelo, iZettle and several others on the fintech scene broke the bundle into manageable chunks. Now they are ready to put the bundle back together again. But the new bundle won’t look like the incumbents envision.

As we continue on the path of digitalization, our behavior of buying a home will surely transform, just as much as e-commerce has since the days of paper invoicing and insecure credit card transactions. If they decide to, they could probably transform parts of this market.

Going in that direction is a big (and maybe unlikely) leap, but one that would upend the cash cow that big banks have grown dependent upon. Even if banks get to keep their mortgages, they too are reliant on creating life cycle behavior to sustain ROE, meaning that they need to offer a complete offering to be competitive.

A more likely pathway might be savings and investments. This is the third piece of banking business that’s already on the path to disruption with robo advisors, and digital services intermediating banks. It’s also a market that isn’t as local as mortgages and one that could benefit from Klarna’s position as culturally relevant consumer brand.

So, wherever Klarna chose to go, their bull case, simultaneously puts a gloomy outlook on the large banks. On Klarnas home market, Sweden there are four dominant universal banks (Nordea, SEB, Swedbank and Handelsbanken) that have a combined market cap of about 800 BN SEK. At the last round, Klarna had a valuation of around 100 BN SEK making it the highest valued non-listed fintech company in Europe.

But it won’t stop there. It’s not far-fetched to think that by the time of their IPO or not long thereafter, Klarna will be worth more than Handelsbanken, Swedbank and SEB combined. This will be due to a substantially higher valuation of Klarna, and a stagnant or lower valuation of universal banks.

This is not advice, nor a financial analysis. It’s merely a business case that can be used as insight. If you like to receive future updates and thoughts on business, strategy and communication drop your email below.

There are so many stories out there on Klarna and the disruption that goes on in the payments industry atm. Here are some of what i read as I was writing this text.

https://www.forbes.com/sites/soonyu/2020/07/14/how-one-fintech-unicorn-became-a-fashion-destination/

https://manassaloi.com/booksummaries/2016/03/10/narratives-numbers-damodaran.html

https://fintechradar.substack.com/p/issue-36-why-its-so-hard-to-make

https://blog.usebutton.com/in-the-buy-now-pay-later-wars-paypal-is-primed-for-dominance

https://apexx.global/blog/buy-now-pay-later-bringing-back-the-golden-age-of-consumers-spendings